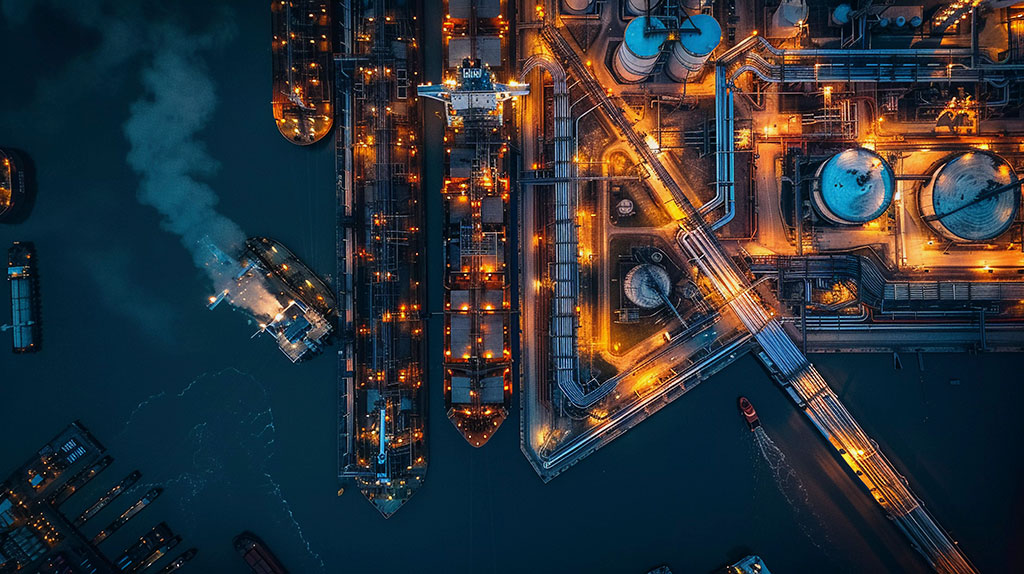

The marine industry enters 2026 with stable demand and ongoing uncertainty. Rather than sudden disruption, the year is shaped by gradual shifts that require careful planning and operational flexibility. Maritime operators continue to prioritize fuel reliability, cost control, and efficiency as core elements of their strategy.

For Puerto Rico, the Caribbean, and nearby export corridors, regional conditions matter. Shorter routes, island-based logistics, and exposure to weather events make dependable local supply and operational agility especially important as operators prepare for the year ahead.

Key trends and forecasts for the marine market in 2026

Several macroeconomic factors will influence the marine market throughout 2026. Global trade is expected to grow at a moderate pace, supporting consistent shipping activity without major expansion.

Financing conditions remain tighter than in previous years, prompting many operators to focus on optimizing existing fleets rather than pursuing aggressive growth.

Energy markets continue to reflect global uncertainty. Fuel availability and pricing are affected by refining capacity, transportation constraints, and compliance requirements. For maritime operators, this reinforces the importance of fuel strategies that prioritize predictability, availability, and strong supplier relationships.

Forecast 1: fuel price volatility and supply chain constraints

Fuel price volatility remains a key concern in 2026. Marine fuel oil, ULSD, and lubricants may experience periodic fluctuations driven by global market movements and logistical factors. While extreme price swings are not expected overall, short-term variability can still affect operating budgets.

Supply chain constraints also remain relevant. Regions that depend on a limited number of supply hubs are more exposed to disruptions from weather events, port congestion, or infrastructure constraints. Operators with access to flexible sourcing options and reliable regional suppliers are often better positioned to manage these risks.

Forecast 2: rising demand in Caribbean and Latin American shipping lane

Shipping activity across Caribbean and Latin American routes continues to increase, supported by regional trade, tourism, and infrastructure-related demand. This growth places additional pressure on ports and fueling operations, especially for vessels operating on tight schedules.

As a result, operators are placing greater emphasis on efficient bunkering solutions that reduce time in port. Well-coordinated fuel deliveries help improve vessel utilization and support smoother operations across short and medium range routes.

Forecast 3: M&A and consolidation among fuel and lubricant providers

Consolidation within the fuel and lubricant supply sector continues. Larger companies are expanding their reach through acquisitions, reshaping the provider landscape. While consolidation can offer scale, it may reduce flexibility for customers who require tailored service and fast response times.

This environment creates opportunities for regional providers with strong infrastructure and local expertise. Maritime operators increasingly value partners who offer responsive service, clear communication, and solutions aligned with regional operating conditions.

Forecast 4: niche growth in yacht support and boutique cruise operators

Premium maritime segments, including yacht support and boutique cruise operations, show steady growth across the Caribbean. These vessels typically require high-quality fuels, low-sulfur products, and specialized lubricants, as well as flexible delivery schedules.

Service expectations in these segments are high. Reliability, attention to detail, and the ability to adapt to changing itineraries are essential. Suppliers that understand these operational needs play a key role in supporting this niche but growing market.

Opportunities for vessel operators in 2026

In 2026, vessel operators can strengthen their position by optimizing fuel supply and logistics. Flexible supply agreements can help address price variability while maintaining access to reliable fuel. In general, arrangements that balance stability with adaptability offer stronger long-term value.

Outsourcing fuel logistics to specialized partners is another opportunity. This approach can reduce operational complexity, limit exposure to supply disruptions, and allow internal teams to focus on core activities. Fuel planning becomes a strategic tool that supports efficiency and operational continuity.

Why Royal Petroleum is your strategic partner in a changing market

Royal Petroleum provides reliable marine fuel and lubricant solutions supported by regional infrastructure and local expertise. With delivery capabilities across Puerto Rico and the Caribbean, the company helps maritime operators reduce risk, improve efficiency, and maintain operational continuity. Key benefits include:

- Regional infrastructure and delivery coverage throughout Puerto Rico and the Caribbean.

- Certified marine fuels and specialized lubricants suited for modern engine requirements.

- Local expertise that supports risk mitigation and operational efficiency.

- Responsive service designed to ensure consistent vessel operations.

Align your operations with 2026 market shifts today

As the marine market evolves in 2026, aligning fuel strategy with operational realities is essential. Contact our commercial team at Royal Petroleum at info@royalpetroleumpr.net to discuss your operational needs.

Preparing today helps ensure smoother, more reliable operations throughout the year ahead.

Sources:

- S. Energy Information Administration. Short-Term Energy Outlook (STEO). U.S. Energy Information Administration, Jan. 2026, https://www.eia.gov/outlooks/steo/.

- S. Energy Information Administration. Short-Term Energy Outlook (STEO): Full Report. U.S. Energy Information Administration, Jan. 2026, https://www.eia.gov/outlooks/steo/pdf/steo_full.pdf.

- United Nations Conference on Trade and Development (UNCTAD). Review of Maritime Transport 2025: Staying the Course in Turbulent Waters. UNCTAD, Sept. 2025, https://unctad.org/publication/review-maritime-transport-2025.

- United Nations Conference on Trade and Development (UNCTAD). Review of Maritime Transport 2025. UNCTAD, 2025, https://unctad.org/system/files/official-document/rmt2025_en.pdf.

- Clarksons Research. Shipping Review & Outlook. Clarksons Research, Sept. 2025, https://insights.clarksons.net/shipping-review-outlook/.

- S&P Global Commodity Insights. “Commodities 2026: Oil bunker trades face soft demand growth, peak VLSFO.” S&P Global, 15 Dec. 2025, https://www.spglobal.com/energy/en/news-research/latest-news/shipping/121525-commodities-2026-oil-bunker-trades-face-soft-demand-growth-peak-vlsfo.

- S. Energy Information Administration. “U.S. Distillate Fuel Oil Inventories.” Today in Energy, U.S. Energy Information Administration, Sept. 2025, https://www.eia.gov/todayinenergy/detail.php?id=66124.

- “Goldman projects lower oil prices in 2026 as supply swells.” Reuters, 12 Jan. 2026, https://www.reuters.com/business/energy/goldman-projects-lower-oil-prices-2026-supply-swells-2026-01-12/.